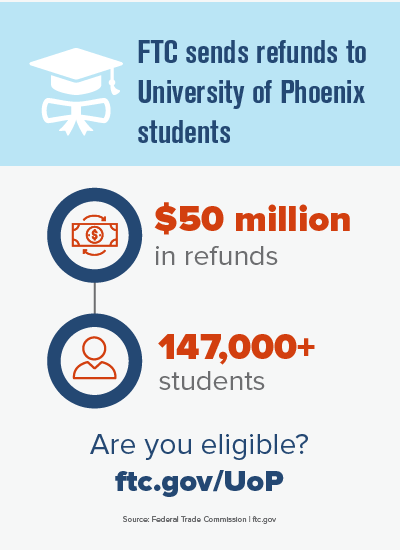

March 24, 2021by Bridget Small Division of Consumer & Business Education

The FTC is sending a total of almost $50 million to nearly 147,500 students of the University of Phoenix. The money comes from the University’s 2019 settlement with the FTC, when the FTC charged the school with using deceptive ads to attract students. According to the FTC, the ads gave the false impression that the University worked with companies like AT&T, Yahoo!, and Microsoft to create job opportunities for students and to shape its programs for the jobs. (Just to be clear: they didn’t.)

These payments are going to students who did not already get their debt cancelled by the University of Phoenix as part of the settlement. These students also meet these requirements:

- They first enrolled in an associate’s, bachelor’s, or master’s degree program at the University of Phoenix between October 15, 2012 and December 31, 2016;

- They paid more than $5,000 to the University (using cash, student loans, military benefits, or a combination);

- They did not object when the University of Phoenix sent them a notice asking if it could give their information to the FTC.

The average payment is $337. Most students will get a check in the mail. It’ll come from the FTC’s refund administrator, Rust Consulting. The checks will expire after 90 days, on June 22, 2021. But about 700 students will get payment through PayPal. The FTC will send an email to people who will get PayPal payments before PayPal sends the payment. Those payments will be available for 30 days, until April 22, 2021. Learn more about University of Phoenix payments and the FTC refund program.

If you think you might be getting a payment, know this: the FTC will never ask you to pay or give sensitive information before it sends you a payment. Not your Social Security, bank account, or credit card number. If someone says they’re from the FTC, but they ask for money, that’s a scam. If you spot a scam, fraud or bad business practice, please tell the FTC at ReportFraud.ftc.gov.